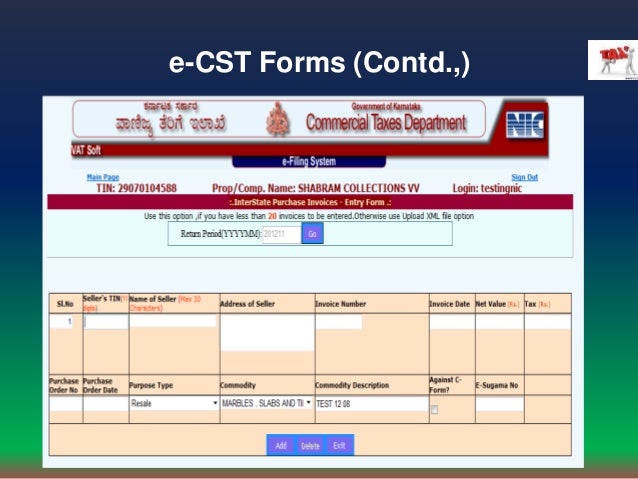

Features of New e-Way Bill system: Click Browse and select the XML file. Once the errors are corrected, the file can be validated again. The validated file needs to be uploaded to the department website. On 21 October

| Uploader: | Samugal |

| Date Added: | 1 September 2006 |

| File Size: | 64.93 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 40040 |

| Price: | Free* [*Free Regsitration Required] |

This number can be quoted at the check post, for quick clearance of goods.

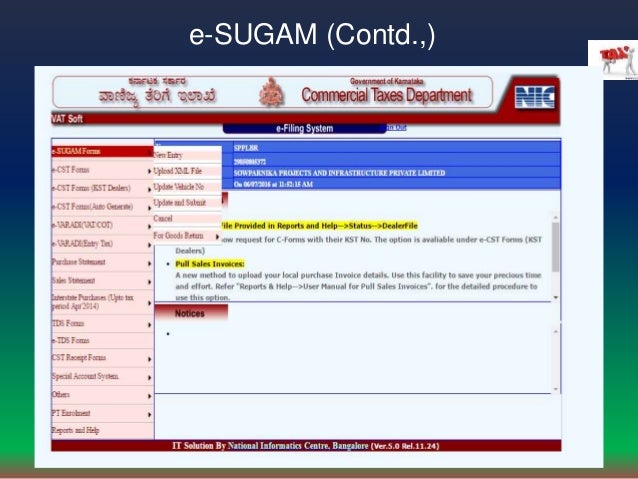

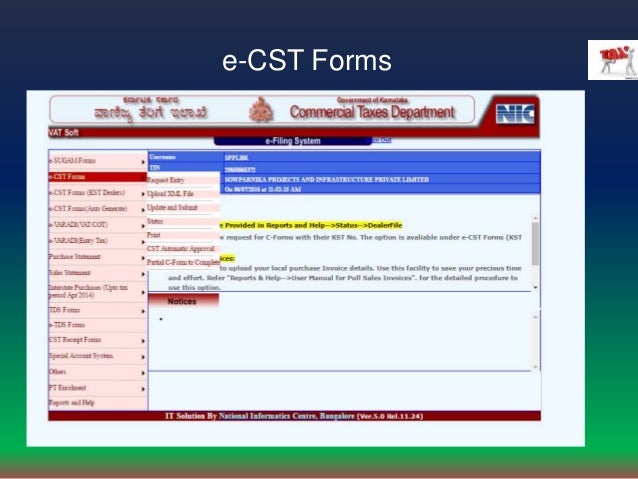

e-Sugam (Karnataka)

Subscribe to the latest topics: Now, the concerned clerk has to call the subam workers in midnight and wait to get the sugam number. Start using the e-way Bill system from today… The issues related to registration of e-Way Bill system have been resolved. On time limit for the e-sugam filing, Holla said e-sugam will have time vailidity depending on the distance of the consignment booked. But our customer now asking for e-sugam no.

e sugam form limits

Till the number is given the dispatch has to wait. It takes only 2 minutes to raise an e sugam so better you raise e sugam immeidately and move the vehcile only after getting e sugam to avoid any possible future problem with dept as well as at check post. Hi, Your Query is not clear. If the distance from the origin of the goods to the destination is between kms to kms - Validity period is 5 days from the day of upload.

All kinds of sugaj parts and accessories. For each transaction, the forj acknowledgement is generated with a unique number, and is a valid document for transportation of goods.

All kinds of electrical goods including appliances The Commercial Taxes Department of Karnataka has introduced e-Sugam to upload the transportation details of notified goods before the movement of such goods. It can be raised only on current date of date of transacitons you can keep a future possible date.

e sugam form limits - VAT Forum

Similarly, by choosing Excel format in the Exporting screen, eSugam file can be exported in Excel format. Under the notification, it is the consignee who will be held responsible for wrong or inaccurate information and is liable to be penalised. Oil seeds including coconut and copra Set Content Preference Professional. The tax payer can also generate and manage multiple sub-users and assign them the roles on the e-way bill system.

The vehicle number can be entered by the tax payer or the transporter. Consequently, it is affecting their business. On 29 September Invalid username or password. vxt

To upload the validated file to the department website. They feel the process is difficult and a nuisance. On 02 August All taxable goods which are transported for purposes other than as a result of sale are notified for mandatory uploading in the department's website at the time of dispatch.

Is it necessary for us to get e-sugam no. On 21 October Ores of all kinds.

We are into service where we lease our equipment to EPC companies. Start using the e-way Bill system from today…. Step by Step Appaly E-Sugam. Alternatively, you can log in using: Once the errors are corrected, the file can be validated again.

No comments:

Post a Comment